Qiziqish - Interest

Qiziqish, yilda Moliya va iqtisodiyot, a dan to'lov qarz oluvchi yoki depozitni qabul qiluvchi moliya muassasasini a qarz beruvchi yoki omonatchiga qaytarib berilgandan yuqori miqdor asosiy summa (ya'ni qarz miqdori), ma'lum bir stavka bo'yicha.[1] A dan farq qiladi haq qarz oluvchi qarz beruvchiga yoki boshqa birovga to'lashi mumkin. Bundan tashqari, u ajralib turadi dividend bu kompaniya tomonidan o'z aksiyadorlariga (egalariga) to'lanadi foyda yoki zaxira, lekin oldindan belgilab qo'yilgan stavka bo'yicha emas, balki olingan mukofotdagi ulush sifatida mutanosib ravishda xavf olingan daromad umumiy xarajatlardan oshib ketganda, tadbirkorlarni qabul qilish.[2][3]

Masalan, mijoz odatda foizlarni to'laydi qarz olish bankdan, shuning uchun ular bankka qarz olgan miqdoridan ko'proq miqdorni to'laydilar; yoki mijoz o'z jamg'armalari bo'yicha foizlar topishi mumkin va shuning uchun ular dastlab qo'yganlaridan ko'proq pul olishlari mumkin. Jamg'arma holatida mijoz qarz beruvchidir, bank esa qarz oluvchi rolini o'ynaydi.

Foiz farq qiladi foyda, foizlar qarz beruvchi tomonidan olinadi, foyda esa egasi ning aktiv, sarmoya yoki korxona. (Foizlar foyda olishning bir qismi yoki to'liq qismi bo'lishi mumkin sarmoya, lekin ikkita tushuncha bir-biridan an dan ajralib turadi buxgalteriya hisobi istiqbol.)

The foiz stavkasi ma'lum bir davrda to'langan yoki olingan foizlar miqdoriga bo'linib tengdir asosiy summa qarzga olingan yoki qarzga berilgan (odatda foizda ko'rsatilgan).

Murakkab qiziqish foizlar asosiy qarzga qo'shimcha ravishda oldingi foizlar evaziga olinishini anglatadi. Murakkablashuv tufayli qarzning umumiy miqdori haddan tashqari o'sib boradi va uning matematik o'rganilishi sonning aniqlanishiga olib keldi e.[4] Amalda foizlar ko'pincha kunlik, oylik yoki yillik hisoblab chiqiladi va uning ta'siriga uning aralashma darajasi katta ta'sir ko'rsatadi.

Tarix

Tarixchining fikriga ko'ra Pol Jonson, "oziq-ovqat pullari" ni qarz berish odatiy hol edi Yaqin Sharq miloddan avvalgi 5000 yildayoq tsivilizatsiyalar. Urug'lar va hayvonlarni o'zlarini ko'paytirishi mumkin bo'lgan dalil qiziqishni oqlash uchun ishlatilgan, ammo qadimgi yahudiylarning diniy taqiqlariga qarshi sudxo'rlik (נשך NeSheKh) "boshqacha ko'rinishni" ifodalagan.[5]

Murakkab qiziqishning dastlabki yozma dalillari miloddan avvalgi 2400 yillarga to'g'ri keladi.[6] Yillik foiz stavkasi taxminan 20% ni tashkil etdi. Qo'shma qiziqish qishloq xo'jaligini rivojlantirish uchun zarur bo'lgan va urbanizatsiya uchun muhim bo'lgan.[7][shubhali ]

Yaqin Sharqning qiziqish haqidagi an'anaviy qarashlari ularni ishlab chiqargan jamiyatlarning urbanizatsiyalashgan, iqtisodiy jihatdan rivojlangan xarakterining natijasi bo'lsa, yahudiylarning foizlarga bo'lgan yangi taqiqlanishi cho'ponlik, qabila ta'sirini ko'rsatdi.[8] Miloddan avvalgi 2-ming yillikning boshlarida, chorva mollari yoki g'alla evaziga ishlatilgan kumush o'z-o'zidan ko'payishi mumkin emasligi sababli Eshnunna qonunlari qonuniy foiz stavkasini o'rnatdi, xususan depozitlar bo'yicha mahr. Dastlabki musulmonlar buni chaqirdilar riba, bugungi kunda foizlarni to'lash sifatida tarjima qilingan.[9]

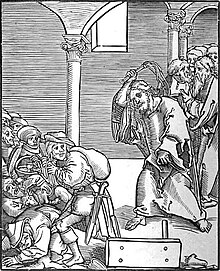

The Nikeyaning birinchi kengashi, 325 yilda taqiqlangan ruhoniylar bilan shug'ullanishdan sudxo'rlik[10] oyiga 1 foizdan yuqori foizli kreditlar (12,7 foiz) sifatida belgilangan AER ). To'qqizinchi asr ekumenik kengashlar ushbu qoidani ilohiylik.[10][11] Katolik cherkovi Sxolastika davrida qiziqishga qarshi qarshilik kuchaygan, hatto uni himoya qilish a deb hisoblangan bid'at. St. Tomas Akvinskiy, etakchi dinshunos Katolik cherkovi, foizlarni undirish noto'g'ri, chunki u "ikki marta zaryadlash ", narsa uchun ham, undan foydalanish uchun ham zaryad olish.

In o'rta asrlar iqtisodiyoti, kreditlar umuman zaruriyatning oqibati edi (yomon hosil, ish joyidagi yong'in) va shu sharoitda foizlarni undirish axloqiy tanbeh deb hisoblanadi.[iqtibos kerak ] Bu, shuningdek, axloqiy jihatdan shubhali deb hisoblangan, chunki pulni qarz berish yo'li bilan biron bir tovar ishlab chiqarilmagan va shu sababli, temirchilik yoki dehqonchilik kabi to'g'ridan-to'g'ri jismoniy ishlab chiqarish bilan shug'ullanadigan boshqa faoliyatlardan farqli o'laroq, uni qoplash kerak emas.[12] Xuddi shu sababga ko'ra, qiziqish ko'pincha yomon ko'rilgan Islom tsivilizatsiyasi, deyarli barcha olimlarning fikriga ko'ra, Qur'on foizlarni undirishni aniq ta'qiqlaydi.

O'rta asr huquqshunoslari mas'uliyatli qarz berishni rag'batlantirish va sudxo'rlik taqiqlarini chetlab o'tish uchun bir nechta moliyaviy vositalarni ishlab chiqdilar Contractum trinius.

In Uyg'onish davri davr, odamlarning katta harakatchanligi tijoratning o'sishiga va buning uchun tegishli sharoitlarning paydo bo'lishiga yordam berdi tadbirkorlar yangi, serdaromad bizneslarni boshlash uchun. Qarzga olingan pullar endi iste'mol uchun emas, balki ishlab chiqarish uchun ham bo'lganligini hisobga olsak, foizlar endi bir xil tarzda ko'rib chiqilmadi.

Manipulyatsiya orqali foiz stavkalarini boshqarishga birinchi urinish pul ta'minoti tomonidan qilingan Banque de France 1847 yilda.[iqtibos kerak ]

Islomiy moliya

20-asrning ikkinchi yarmida foizsiz o'sish kuzatildi Islomiy bank va moliya, Islom qonunlarini moliya institutlari va iqtisodiyotga tatbiq etuvchi harakat. Ba'zi mamlakatlar, shu jumladan Eron, Sudan va Pokiston o'zlarining moliyaviy tizimlariga bo'lgan qiziqishni yo'q qilish choralarini ko'rdilar.[iqtibos kerak ] Foizsiz qarz beruvchi foizlarni undirishdan ko'ra, foyda yo'qotishlarni taqsimlash sxemasiga sherik sifatida sarmoya kiritish orqali xavfni bo'lishadi, chunki foizlarni oldindan belgilab qo'yilgan kreditni qaytarish, shuningdek puldan pul ishlash qabul qilinishi mumkin emas. Barcha moliyaviy operatsiyalar aktivlar tomonidan ta'minlanishi kerak va kredit berish xizmati uchun foizlar yoki to'lovlar olinmaydi.

Matematika tarixida

Bu shunday deb o'ylashadi Jeykob Bernulli matematik doimiyni kashf etdi e haqidagi savolni o'rganish orqali aralash foiz.[13] U shuni angladiki, agar $ 1.00 dan boshlanib, yiliga 100% foiz to'laydigan hisobvaraq bo'lsa, yil oxirida bu qiymat $ 2.00; agar foizlar hisoblanib, yiliga ikki marta qo'shilsa, $ 1 1,5 ga ko'paytirilib, 1,00 × 1,5 hosil bo'ladi.2 = 2,25 dollar. Har chorakda birikma $ 1,00 × 1,25 hosil beradi4 = 2.4414 dollar ... va boshqalar.

Bernulli, agar birikma chastotasi cheksiz oshirilsa, bu ketma-ketlikni quyidagicha modellashtirish mumkinligini payqadi.

qayerda n bir yil ichida foizlar ko'paytirilishi kerak bo'lgan son.

Iqtisodiyot

Iqtisodiyotda foiz stavkasi narx hisoblanadi kredit va u rolini o'ynaydi kapitalning qiymati. A erkin bozor iqtisodiyot, foiz stavkalari qonuniga bo'ysunadi talab va taklif ning pul ta'minoti, va foiz stavkalarining odatda noldan yuqori bo'lish tendentsiyasining bir izohi - bu tanqislik qarz mablag'lari.

Asrlar davomida turli xil maktablar foizlar va foiz stavkalarini tushuntirishlarni ishlab chiqdilar. The Salamanka maktabi qarz oluvchiga nafaqa miqdorida foizlarni to'lash va qarz beruvchi uchun mukofot sifatida qarz oluvchi tomonidan olingan foizlar defolt xavfi.[iqtibos kerak ] XVI asrda, Martin de Azpilueta qo'llaniladigan a vaqtni afzal ko'rish argument: kelgusida emas, balki hozirda berilgan yaxshilikni olish afzaldir. Shunga ko'ra, foizlar qarz beruvchi pulni sarflash foydasidan voz kechgan vaqt uchun kompensatsiya hisoblanadi.

1770 yilda nega foiz stavkalari odatda noldan yuqori degan savolga frantsuz iqtisodchisi Anne-Robert-Jak Turgo, Baron-de-Laun taklif qildi fruktifikatsiya nazariyasi. Qo'llash orqali Tanlov narxi argument, kredit stavkasini bilan solishtirganda rentabellik darajasi a qiymatining formulasini qo'llagan holda, qishloq xo'jaligi erlarida va matematik dalillarda abadiylik plantatsiyaga, u foiz stavkasi nolga yaqinlashgani sababli er qiymati cheksiz ko'tarilishini ta'kidladi. Er qiymati ijobiy bo'lib qolishi uchun va foiz stavkasi noldan yuqori bo'ladi.

Adam Smit, Karl Menger va Frederik Bastiat foiz stavkalari nazariyalarini ham ilgari surdi.[14] 19-asr oxirida Shved iqtisodchisi Knut Uiksell uning 1898 yilda Foizlar va narxlar tabiiy va nominal foiz stavkalari farqiga asoslangan iqtisodiy inqirozning keng qamrovli nazariyasini ishlab chiqdi. 1930-yillarda Uiksellning yondashuvi yaxshilandi Bertil Ohlin va Dennis Robertson va nomi bilan tanilgan qarz mablag'lari nazariya. Davrning boshqa sezilarli foiz stavkalari nazariyalari Irving Fisher va Jon Maynard Keyns.

Hisoblash

Oddiy qiziqish

Oddiy qiziqish faqat asosiy summa yoki asosiy summaning qolgan qismi bo'yicha hisoblanadi. Ta'sirini istisno qiladi birikma. Oddiy foizlar bir yildan tashqari, masalan, har oyda qo'llanilishi mumkin.

Oddiy foizlar quyidagi formula bo'yicha hisoblanadi:

qayerda

- r oddiy yillik stavka foizi

- B dastlabki qoldiq

- m o'tgan vaqtlar soni va

- n foizlarni qo'llash chastotasi.

Masalan, kredit karta egasining qarzdorligi 2500 AQSh dollarini va yillik oddiy deb tasavvur qiling stavka foizi 12,99% yiliga, har oyda qo'llaniladi, shuning uchun foizlarni qo'llash chastotasi yiliga 12 ga teng. Bir oydan ortiq,

foizlar olinadi (eng yaqin foizga yaxlitlanadi).

3 oy davomida qo'llaniladigan oddiy foizlar bo'ladi

Agar karta egasi har 3 oyning oxirida faqat foizlarni to'lasa, to'lagan foizlarning umumiy miqdori bo'ladi

bu yuqorida ko'rsatilgan 3 oy davomida qo'llaniladigan oddiy foizlardir. (Bir tsentlik farq eng yaqin tsentrga yaxlitlash tufayli yuzaga keladi.)

Murakkab qiziqish

Murakkab foizlarga ilgari to'plangan foizlar bo'yicha olingan foizlar kiradi.

Masalan, depozit sertifikati bilan yiliga 6 foiz (ya'ni yiliga ikki marta 3 foizli kuponlar) to'laydigan obligatsiyani solishtiring (GIC ) yiliga bir marta 6 foizli foiz to'laydi. Foizlarning umumiy to'lovi har ikkala holatda ham 100 dollarlik nominal qiymati uchun 6 AQSh dollarini tashkil etadi, ammo ikki yilda bir marta beriladigan obligatsiya egasi atigi 6 oydan so'ng yiliga 6 dollarning yarmini oladivaqtni afzal ko'rish ), va shuning uchun dastlabki 6 oydan so'ng birinchi $ 3 kupon to'lovini qayta investitsiya qilish va qo'shimcha foizlar olish imkoniyati mavjud.

Masalan, investor yiliga ikki marta kupon to'laydigan AQSh dollaridagi obligatsiyaning nominal qiymatini $ 10,000 sotib oldi va bu obligatsiyaning oddiy yillik kupon stavkasi yiliga 6 foizni tashkil etadi deylik. Bu shuni anglatadiki, har 6 oyda emitent obligatsiya egasiga nominal qiymati uchun 100 dollar uchun 3 dollardan kupon to'laydi. 6 oy oxirida emitent egasiga quyidagilarni to'laydi:

Obligatsiyaning bozor narxini 100 ga teng deb hisoblasak, shuning uchun u nominal qiymati bo'yicha savdo qilmoqda, bundan keyin egasi kuponni darhol obligatsiyaning yana 300 dollar nominal qiymatiga sarflab, qayta tiklaydi. Umuman olganda, investor hozirda quyidagilarga ega:

va shuning uchun keyingi 6 oyning oxirida kupon oladi:

Obligatsiya avvalgi narxda qolsa, investor to'liq 12 oy oxirida jami qiymati yig'iladi:

va jami ishlagan investor:

Uchun formula yillik ekvivalent foiz stavkasi bu:

qayerda

- r - foizlarning oddiy yillik stavkasi

- n - foizlarni qo'llash chastotasi

Masalan, 6% oddiy yillik stavka bo'yicha yillik ekvivalent stavka:

Boshqa formulalar

Ajoyib muvozanat Bn keyin qarz n muntazam to'lovlar har bir davrni davriy foizlarga muvofiq o'sish koeffitsienti bilan oshiradi, so'ngra to'langan miqdorga kamayadi p har bir davr oxirida:

qayerda

- men = kasr shaklidagi oddiy yillik stavka (masalan, 10% = 0,10. Kredit stavkasi bu to'lovlar va qoldiqlarni hisoblash uchun ishlatiladigan stavka).

- r = davr stavkasi (masalan, men/ Oylik to'lovlar uchun 12) [2]

- B0 = ga teng bo'lgan dastlabki qoldiq asosiy summa

Takroriy almashtirish orqali iboralar olinadi Bnga to'g'ri chiziqli mutanosib bo'lgan B0 va p va a ning qisman yig'indisi uchun formuladan foydalanish geometrik qatorlar natijalar

Ushbu ifodaning echimi p xususida B0 va Bn ga kamaytiradi

Agar kredit tugashi kerak bo'lsa, to'lovni topish uchun n to'lovlar bir to'plamBn = 0.

PMT funktsiyasi elektron jadval kreditlar bo'yicha oylik to'lovni hisoblash uchun dasturlardan foydalanish mumkin:

Joriy balansda faqat foizlar uchun to'lov bo'ladi

Jami foizlar, MenT, kredit bo'yicha to'lanadi

Muntazam jamg'arma dasturining formulalari o'xshash, ammo to'lovlar ayirboshlash o'rniga balansga qo'shiladi va to'lov formulasi yuqoridagi kabi salbiy hisoblanadi. Ushbu formulalar faqat taxminiy hisoblanadi, chunki qarzlarning haqiqiy qoldig'iga yaxlitlash ta'sir qiladi. Kredit oxirida kam to'lovni oldini olish uchun to'lovni keyingi foizgacha yaxlitlash kerak.

Shunga o'xshash kreditni ko'rib chiqing, ammo yangi muddati unga teng k yuqoridagi muammoning davrlari. Agar rk va pk bizda endi yangi tarif va to'lov

Buni B ifodasi bilan taqqoslashk yuqorida biz buni ta'kidlaymiz

va

Oxirgi tenglama har ikkala muammo uchun bir xil bo'lgan doimiylikni aniqlashga imkon beradi,

va Bk sifatida yozilishi mumkin

Uchun hal qilish rk uchun formulani topamiz rk ma'lum miqdorlarni o'z ichiga olgan va Bk, keyingi qoldiq k davrlar,

B yildan beri0 kreditdagi har qanday qoldiq bo'lishi mumkin, formulalar har qanday ikkita qoldiq uchun ishlaydi k davrlar va yillik foiz stavkasi uchun qiymatni hisoblash uchun ishlatilishi mumkin.

B* bu a o'lchov o'zgarmas chunki u muddat o'zgarishi bilan o'zgarmaydi.

Uchun tenglamani qayta tuzish B* biri transformatsiya koeffitsientini oladi (o'lchov omili ),

- (qarang binomiya teoremasi )

va biz buni ko'ramiz r va p xuddi shu tarzda o'zgartirish,

Balansdagi o'zgarish ham xuddi shunday o'zgaradi,

bu yuqoridagi formulalarda topilgan ba'zi koeffitsientlarning ma'nosi haqida tushuncha beradi. Yillik stavka, r12, yiliga faqat bitta to'lovni nazarda tutadi va oylik to'lovlar uchun "samarali" stavka emas. Oylik to'lovlar bilan har oylik foizlar har bir to'lovdan to'lanadi, shuning uchun unga qo'shilmaslik kerak va yillik stavka 12 ·r yanada mantiqiy bo'lar edi. Agar kimdir faqat foizlar bo'yicha to'lovlarni amalga oshirgan bo'lsa, yil davomida to'lanadigan summa 12 ·r·B0.

O'zgartirish pk = rk B* ning tenglamasiga Bk biz olamiz,

Beri Bn = 0 uchun biz hal qila olamiz B*,

Qaytadan uchun formulaga almashtirish Bk ning chiziqli funktsiyasi ekanligini ko'rsatadi rk va shuning uchun λk,

Bu qoldiqlarni taxmin qilishning eng oson usuli λk ma'lum. Uchun birinchi formulaga almashtirish Bk yuqorida va uchun hal qilish λk+1 biz olamiz,

λ0 va λn formulasi yordamida topish mumkin λk yuqorida yoki hisoblash λk dan λ0 = 0 dan λn.

Beri p = rB* to'lov formulasi quyidagicha kamayadi:

va kredit olish davridagi o'rtacha foiz stavkasi

bu kamroq r agarn > 1.

Chegirma vositalari

- AQSh va Kanadaning (qisqa muddatli davlat qarzlari) veksellari foizlar uchun boshqacha hisob-kitoblarga ega. Ularning foizlari (100 -P)/P qayerda P to'langan narx. Uni bir yilgacha normallashtirish o'rniga foizlar kunlar soniga qarab taqsimlanadi t: (365/t) 100. (Shuningdek qarang: Kun sanash bo'yicha anjuman ). Umumiy hisoblash ((100 -P)/P)·((365/t) · 100). Bu narxni deb nomlangan jarayon bilan hisoblashga teng oddiy foiz stavkasi bo'yicha diskontlash.

Bosh barmoq qoidalari

78s qoidasi

Elektron hisoblash quvvati keng tarqalmaganidan oldingi davrda Amerika Qo'shma Shtatlarida bir tekis stavka bo'yicha iste'mol kreditlari 78-lar qoidasi yoki "raqamlar yig'indisi" usuli bilan baholanardi. (1 dan 12 gacha bo'lgan butun sonlarning yig'indisi 78 ga teng.) Bu usul oddiy hisoblashni talab qildi.

Kredit muddati davomida to'lovlar doimiy bo'lib qoladi; ammo, to'lovlar tobora kamroq miqdorda foizlarga ajratiladi. Bir yillik kreditda, birinchi oyda, qarz muddati davomida barcha foizlarning 12/78 qismi to'lashi kerak; ikkinchi oyda, 11/78; barcha qiziqishlarning atigi 1/78 qismi olinishi kerak bo'lgan o'n ikkinchi oyga boradi. 78-yillar qoidasining amaliy samarasi muddatli kreditlarni erta to'lashni qimmatroq qilishdir. Bir yillik kredit uchun oltinchi oyga qadar barcha qarzlarning taxminan 3/4 qismi olinadi va keyinchalik asosiy qarzni to'lashi samarali foiz stavkalari to'lovlarni hisoblash uchun ishlatilgan APYdan ancha yuqori bo'lishiga olib keladi.[15]

1992 yilda Qo'shma Shtatlar ipotekani qayta moliyalashtirish va boshqa iste'mol kreditlari bilan bog'liq bo'lgan "78-lar qoidalari" foizlaridan foydalanish muddati besh yil davomida noqonuniy deb e'lon qilindi.[16] Ayrim boshqa yurisdiktsiyalar 78-yillarning qoidalarini ayrim turdagi kreditlar, xususan iste'mol kreditlariga nisbatan qo'llashni noqonuniy deb e'lon qildilar.[15]

72-qoida

Berilgan foiz stavkasi bo'yicha pulning ikki baravar ko'payishi, ya'ni biriktirilgan foizlarning dastlabki depozitga yetishi yoki undan oshib ketishi uchun qancha vaqt ketishini taxmin qilish uchun 72 foiz foiz stavkasiga bo'ling. Masalan, yillik 6 foizli foiz stavkasini qo'shganda, pulning ikki baravar ko'payishi uchun 72/6 = 12 yil kerak bo'ladi.

Qoidalar foiz stavkalari 10% gacha yaxshi ko'rsatkichni taqdim etadi.

Foiz stavkasi 18 foiz bo'lgan taqdirda, 72 qoidasi 72/18 = 4 yildan keyin pul ikki baravar ko'payishini bashorat qilmoqda.

Foiz stavkasi 24 foiz bo'lgan taqdirda, qoida 72/24 = 3 yildan keyin pul ikki baravar ko'payishini taxmin qilmoqda.

Bozor foiz stavkalari

Investitsiyalar uchun bozorlar mavjud (ularga pul bozori, obligatsiyalar bozori, shuningdek banklar kabi chakana moliya institutlari kiradi) foiz stavkalari. Har bir aniq qarz foiz stavkasini aniqlashda quyidagi omillarni hisobga oladi:

Imkoniyat narxi va kechiktirilgan iste'mol

Tanlov narxi pul qo'yilishi mumkin bo'lgan har qanday boshqa foydalanishni, shu jumladan boshqalarga qarz berish, boshqa joyga sarmoya kiritish, naqd pulni ushlab turish yoki mablag'larni sarflashni o'z ichiga oladi.

Inflyatsiyaga teng foizlarni to'lash kreditorning sotib olish qobiliyatini saqlab qoladi, ammo buning o'rnini qoplamaydi pulning vaqt qiymati yilda haqiqiy shartlar. Qarz beruvchi iste'mol qilishni emas, balki boshqa mahsulotga sarmoya kiritishni afzal ko'rishi mumkin. Raqobatbardosh investitsiyalardan olinadigan daromad, ular talab qiladigan foiz stavkasini belgilovchi omil hisoblanadi.

Inflyatsiya

Qarz beruvchi iste'molni kechiktirayotganligi sababli, ular buni qiladilar tilak, tovarlarning ko'tarilgan narxini to'lash uchun etarli miqdorda tiklanish uchun minimal darajada inflyatsiya. Kelajakdagi inflyatsiya noma'lum bo'lganligi sababli, bunga uchta usul erishish mumkin:

- X foiz stavkasi "plyus inflyatsiya" Ko'p hukumat "real rentabellik" yoki "inflyatsiya indekslangan" obligatsiyalar chiqaradi. Asosiy miqdor yoki foizlar bo'yicha to'lovlar inflyatsiya darajasi bilan doimiy ravishda oshiriladi. Muhokamani quyidagi manzilda ko'ring real foiz stavkasi.

- "Kutilgan" inflyatsiya darajasi to'g'risida qaror qabul qiling. Bu hali ham qarz beruvchini "kutilmagan" inflyatsiya xavfiga duchor qiladi.

- Foiz stavkasini vaqti-vaqti bilan o'zgartirishga ruxsat bering. Qarz muddati davomida "belgilangan foiz stavkasi" bir xil bo'lib qolsa-da, "o'zgaruvchan" yoki "o'zgaruvchan" stavkalar tiklanishi mumkin. Ikkala tomonni almashtirish va almashtirishga imkon beruvchi lotin mahsulotlari mavjud.

Biroq, foiz stavkalari bozor tomonidan belgilanadi va tez-tez sodir bo'ladiki, ular inflyatsiyani qoplash uchun etarli emas: masalan, yuqori inflyatsiya davrida, masalan, neft inqirozi paytida; va hozirgi kunda (2011 yil) inflyatsiyaga bog'liq bo'lgan ko'plab davlat aktsiyalarining real rentabelligi salbiy bo'lganda.

Odatiy

Qarz oluvchining xavfi har doim mavjud bankrot, qochmoq yoki boshqacha tarzda sukut bo'yicha kredit bo'yicha. The tavakkal mukofoti qarz oluvchining yaxlitligini, uning korxonasi muvaffaqiyat qozonish xavfini va garovga qo'yilgan har qanday garovning xavfsizligini o'lchashga urinishlar. Masalan, rivojlanayotgan mamlakatlarga beriladigan kreditlar, AQSh hukumatiga nisbatan, kreditga layoqatlilik farqi tufayli yuqori xavfga ega. Biznesga operatsion kredit liniyasi a ga nisbatan yuqori stavkaga ega bo'ladi ipoteka krediti.

The kreditga layoqatlilik korxonalar hajmi bilan o'lchanadi obligatsiyalarni baholash bo'yicha xizmatlar va individual kredit ballari tomonidan kredit byurolari. Shaxsiy qarz xavfi katta ehtimollikdagi og'ishlarga ega bo'lishi mumkin. Qarz beruvchi o'zining maksimal tavakkalini qoplashni xohlashi mumkin, ammo qarz portfeliga ega bo'lgan kreditorlar tavakkal mukofotini eng mumkin bo'lgan natijalarni qoplash uchun kamaytirishi mumkin.

Foiz stavkalarining tarkibi

Iqtisodiyotda foizlar kredit narxi deb hisoblanadi, shuning uchun ham buzilishlarga duch keladi inflyatsiya. Inflyatsiyani to'g'irlashdan oldingi narxni nazarda tutadigan nominal foiz stavkasi iste'molchiga ko'rinadigan foiz hisoblanadi (ya'ni kredit shartnomasida belgilangan foizlar, kredit karta bayonoti va boshqalar). Nominal foizlar quyidagilardan iborat real foiz stavkasi boshqa omillar qatorida inflyatsiya. Nominal foizlarning taxminiy formulasi:

Qaerda

- men bu nominal foiz stavkasi

- r bu haqiqiy foiz stavkasi

- va π bu inflyatsiya.

Shu bilan birga, barcha qarz oluvchilar va qarz beruvchilar bir xil inflyatsiyaga duch kelgan taqdirda ham bir xil foiz stavkasidan foydalanish imkoniyatiga ega emaslar. Bundan tashqari, kelajakdagi inflyatsiyani kutish har xil, shuning uchun istiqbolli foiz stavkasi bitta real foiz stavkasiga va inflyatsiyaning kutilgan yagona darajasiga bog'liq bo'lishi mumkin emas.

Foiz stavkalari ham bog'liq kredit sifati yoki to'lovni to'lamaslik xavfi. Hukumatlar odatda juda ishonchli qarzdorlar va davlat qimmatli qog'ozlari bo'yicha foiz stavkasi odatda boshqa qarz oluvchilar uchun mavjud bo'lgan foiz stavkasidan past bo'ladi.

Tenglama:

inflyatsiya va kredit xavfi bilan bog'liq taxminlarni kredit muddati davomida nominal va kutilgan real foiz stavkalari bilan bog'laydi, bu erda

- men qo'llaniladigan nominal foiz hisoblanadi

- r kutilayotgan haqiqiy qiziqish

- π kutilayotgan inflyatsiya hisoblanadi va

- v bu hosilning tarqalishi qabul qilingan kredit tavakkaliga ko'ra.

Odatiy foiz

Defolt foizlar - bu qarzdorning qarz shartnomasini jiddiy ravishda buzganidan keyin to'lashi kerak bo'lgan foiz stavkasi.

Odatiy foizlar, odatda, dastlabki foiz stavkasidan ancha yuqori, chunki u qarz oluvchining moliyaviy xavfining kuchayishini aks ettiradi. Standart foizlar qarz beruvchiga qo'shimcha xavfni qoplaydi.

Qarz oluvchi nuqtai nazaridan qarz oladigan bo'lsak, bu ularning bir yoki ikki to'lov muddati davomida muntazam ravishda to'lovni amalga oshirmaslik yoki kredit garovi uchun soliq yoki sug'urta mukofotlarini to'lamaslik, kreditning qolgan barcha muddati uchun foizlarning ancha yuqori bo'lishiga olib keladi.

Banklar turli xil stsenariylarni ajratish uchun kredit shartnomalariga ssuda foizlarini qo'shishga moyildirlar.

Ba'zi yurisdiktsiyalarda foizlar bo'yicha majburiy qoidalar davlat siyosatiga zid ravishda ijro etilmaydi.

Muddat

Qisqa muddatli shartlar ko'pincha defolt va inflyatsiyaga ta'sir qilish xavfini kamaytiradi, chunki yaqin kelajakni bashorat qilish osonroq. Bunday sharoitda qisqa muddatli foiz stavkalari uzoq muddatli foiz stavkalaridan pastroq (yuqoriga qarab qiyalik) egri chiziq ).

Hukumat aralashuvi

Foiz stavkalari odatda bozor tomonidan belgilanadi, ammo davlat aralashuvi - odatda a markaziy bank - qisqa muddatli foiz stavkalariga kuchli ta'sir ko'rsatishi mumkin va bu asosiy vositalardan biridir pul-kredit siyosati. Markaziy bank katta miqdordagi pulni o'zlari belgilaydigan stavka bo'yicha qarz olishni (yoki qarz berishni) taklif qiladi (ba'zan bu ular yaratgan pul sobiq nihilo, ya'ni talab va taklifga, shu sababli bozor foiz stavkalariga katta ta'sir ko'rsatadigan).

Qo'shma Shtatlardagi ochiq bozor operatsiyalari

The Federal zaxira (Fed) pul siyosatini asosan maqsadli yo'naltirish orqali amalga oshiradi federal fondlar stavkasi. Bu banklar bir kecha davomida olingan kreditlar uchun bir-birlaridan undiradigan stavka federal fondlar. Federal fondlar - bu Fed-dagi banklar zaxiralari.

Ochiq bozor operatsiyalari Federal rezerv tomonidan amalga oshiriladigan pul-kredit siyosatining qisqa muddatli foiz stavkalarini boshqarish vositalaridan biridir. Xazinani sotib olish va sotish uchun kuchdan foydalanish qimmatli qog'ozlar, Ochiq bozor stol Nyu-York Federal zaxira banki sotib olish orqali bozorni dollar bilan ta'minlay oladi AQSh G'aznachilik yozuvlari, demak, xalqning pul massasini ko'paytirish. Pul massasini ko'paytirish orqali yoki Jamg'arma mablag'larini etkazib berish (ASF), foizlar pasayadi, chunki banklar o'z zaxiralarida qoladigan dollar miqdoridan oshib ketadi. Ortiqcha zaxira da qarz berilishi mumkin Fed mablag'lari bozorni boshqa banklarga sotish, shuning uchun stavkalarni pasaytiradi.

Foiz stavkalari va kredit xavfi

Ishbilarmonlik tsikli davomida, foiz stavkalari va kredit xavfi bir-biri bilan chambarchas bog'liq. The Jarrow-Turnbull modeli kredit xatarining birinchi modeli bo'lib, uning asosida aniq tasodifiy foiz stavkalari mavjud edi. Lando (2004), Darrel Duffi va Singleton (2003) va van Deventer va Imai (2003) foiz stavkasini chiqaruvchisi ssudani to'lashga qodir bo'lgan hollarda foiz stavkalarini muhokama qilishadi.

Pul va inflyatsiya

Kreditlar va obligatsiyalar pulning ba'zi xususiyatlariga ega va keng pul massasiga kiritilgan.

Milliy hukumatlar (albatta, mamlakat o'z valyutasini saqlab qolish sharti bilan) foiz stavkalariga va shu tariqa bunday kreditlarga bo'lgan talab va taklifga ta'sir qilishi, shu bilan chiqarilgan kreditlar va obligatsiyalarning umumiy miqdorini o'zgartirishi mumkin. Umuman olganda, real foiz stavkasining yuqoriligi keng pul massasini pasaytiradi.

Orqali pulning miqdoriy nazariyasi, pul massasining ko'payishi inflyatsiyaga olib keladi. Bu foiz stavkalari kelajakda inflyatsiyaga ta'sir qilishi mumkinligini anglatadi.[17]

Likvidlik

Likvidlik aktivni adolatli yoki adolatli qiymatga tezda qayta sotish qobiliyatidir. Qanday bo'lmasin, investor har qanday vaqtda uni sotish opsiyasini yo'qotishini qoplash uchun likvidsiz aktivdan likvidga nisbatan yuqori daromad olishni xohlaydi. AQSh G'aznachilik majburiyatlari faol ikkilamchi bozor bilan yuqori likvidli, boshqa ba'zi qarzlar esa kamroq likvidlidir. In ipoteka bozorda, eng past stavkalar ko'pincha sekvritizatsiya qilingan kreditlar sifatida qayta sotilishi mumkin bo'lgan kreditlarga beriladi. Sotuvchilarni moliyalashtirish kabi an'anaviy bo'lmagan kreditlar ko'pincha likvidliligi tufayli yuqori foiz stavkalariga ega.

Qiziqish nazariyalari

Aristotelning qiziqish haqidagi qarashlari

Aristotel va sxolastika o'z kuchi va qurbonligi uchun tovon to'lashdan tashqari, to'lovni talab qilish adolatsiz va pul o'z tabiati bo'yicha steril bo'lganligi sababli, undan vaqtincha ajralib chiqishda yo'qotish yo'q deb hisoblagan. Xatarni qoplash yoki qarz berish muammosini qoplash ushbu sabablarga ko'ra shart emas edi.[18]

XVII-XVIII asrlar davomida qiziqish nazariyasining rivojlanishi

Nikolas Barbon (c.1640 – c.1698) foizlar pul qiymati, degan fikrni "xato" deb ta'riflagan, chunki pul odatda aktivlarni (mollarni va zaxiralarni) sotib olish uchun qarzga olinganligi sababli, qarz uchun olinadigan foizlar ijara turi - "tovarlardan foydalanganlik uchun to'lov".[19] Shumpeterning so'zlariga ko'ra, Barbonning nazariyalari shunga o'xshash qarashlar ilgari surilguncha unutilgan Jozef Massi 1750 yilda.[eslatma 1]

1752 yilda Devid Xum o'zining "Pul to'g'risida" inshoini nashr etdi, bu foizlarni "qarz olishga bo'lgan talab", "ushbu talabni ta'minlash uchun mavjud bo'lgan boyliklar" va "savdo-sotiqdan kelib chiqadigan foyda" bilan bog'liq. Shumpeter[22][sahifa kerak ] Xyum nazariyasini Rikardo va Mill nazariyasidan ustun deb bilgan, ammo foyda haqida ma'lumot sanoatda emas, balki "tijorat" da hayratlanarli darajada to'plangan.

Turgot qiziqish nazariyasini o'zining klassik shakliga yaqinlashtirdi. Sanoatchilar ...

... o'z daromadlarini mablag 'etkazib beradigan kapitalistlar bilan bo'lishish (Qaytish, LXXI). Ikkinchisiga to'g'ri keladigan ulush boshqa barcha narxlar (LXXV) kabi qarz oluvchilar va qarz beruvchilar o'rtasida talab va taklifning o'ynashi bilan belgilanadi, shunda tahlillar boshidanoq narxlarning umumiy nazariyasida mustahkam joylashtirilgan.[2-eslatma]

Foiz stavkasining klassik nazariyasi

Klassik nazariya bir qator mualliflarning, shu jumladan Turgotning, Rikardo,[3-eslatma] Mountfort Longfield,[24] J. S. Mill va Irving Fisher.[25] Tomonidan qattiq tanqid qilindi Keyns[4-eslatma] uning so'zlari shunga qaramay ijobiy hissa qo'shdi.

Mill nazariyasi uning "Siyosiy iqtisod tamoyillari" asarida "Foiz stavkasi" bobida bayon etilgan.[5-eslatma] Uning so'zlariga ko'ra, foiz stavkasi qarz berish va qarz olish talablari o'rtasidagi muvozanatni saqlash uchun o'rnatiladi.[26] Jismoniy shaxslar iste'molni kechiktirish uchun yoki ko'proq miqdordagi maqsad uchun qarz berishadi, chunki ular keyinchalik foizlar evaziga iste'mol qilishlari mumkin bo'ladi. Ular iste'molni taxmin qilish uchun qarz olishadi (nisbiy maqsadga muvofiqligi aks ettirilgan pulning vaqt qiymati ), ammo tadbirkorlar investitsiyalarni moliyalashtirish uchun qarz olishadi va hukumatlar o'z sabablari bilan qarz olishadi. Uchta talab manbai kredit olish uchun raqobatlashadi.[27]

Tadbirkorlik uchun qarz berish qarz berish bilan mutanosib bo'lishi uchun:

Pul uchun foizlar ... ... tartibga solinadi ... kapitalni ishga solish natijasida olinadigan foyda darajasi bilan ...[28]

Rikardo va Millning "foydasi" kapitalning chekka samaradorligi kontseptsiyasi bilan aniqroq amalga oshiriladi (bu tushuncha, garchi kontseptsiya bo'lmasa ham, Keynsga bog'liq)[6-eslatma]), bu uning tannarxiga nisbati sifatida kapitalning qo'shimcha o'sishi natijasida olinadigan yillik daromad sifatida belgilanishi mumkin. Shunday qilib foiz stavkasi r muvozanatda kapitalning chekka samaradorligiga teng bo'ladi r'. Bilan ishlashdan ko'ra r va r' alohida o'zgaruvchilar sifatida biz ularni teng deb hisoblaymiz va bitta o'zgaruvchiga ruxsat beramiz r ularning umumiy qiymatini bildiradi.

Investitsiyalar jadvali men (r) hech bo'lmaganda rentabellik bilan qancha sarmoya kiritish mumkinligini ko'rsatadi r.[7-eslatma] Statsionar iqtisodiyotda, ehtimol diagrammada ko'k egri chiziqqa o'xshash bo'lishi mumkin, bu esa rentabellikdan yuqori rentabellikga sarmoya kiritish imkoniyatlaridan kelib chiqadigan qadam shakli bilan yuzaga keladi. r̂ past rentabellik bilan sarmoya kiritish uchun foydalanilmagan imkoniyatlar mavjud bo'lganda, deyarli charchagan.[29]

Jamg'arma - bu kutilgan iste'molga nisbatan kechiktirilgan ortiqcha va uning daromadga bog'liqligi Keyns tomonidan ta'riflanganidek (qarang). Umumiy nazariya ), ammo klassik nazariyada albatta ortib borayotgan funktsiyasi r. (Bog'liqligi s daromad to'g'risida y nazariyalari ishlab chiqilishidan oldin klassik tashvishlarga aloqador emas edi ishsizlik.) Foiz stavkasi qattiq qizil tejash egri chizig'ining ko'k investitsiya jadvali bilan kesishishi bilan beriladi. Ammo investitsiyalar jadvali deyarli vertikal bo'lsa, daromadning o'zgarishi (o'ta og'ir holatlarda qizil tejamkorlik egri chizig'iga olib keladi) foiz stavkasiga unchalik katta farq qilmaydi.

Ba'zi hollarda tahlil kamroq sodda bo'ladi. Kapitalning yangi shakllariga bo'lgan talabni keltirib chiqaradigan yangi texnikani joriy etish qadamni o'ngga siljitadi va uning tikligini pasaytiradi.[29] Yoki iste'molni kutish istagining to'satdan kuchayishi (ehtimol urush paytida harbiy xarajatlar orqali) mavjud bo'lgan eng ko'p kreditlarni o'zlashtiradi; foiz stavkasi oshadi va sarmoyalar rentabelligi undan oshadigan miqdorga kamayadi.[30] Bu nuqta qizil tejamkorlik egri chizig'i bilan tasvirlangan.

Keynsning tanqidlari

Urush paytida favqulodda xarajatlar bo'lsa, hukumat odatdagi foiz stavkasi bilan qarz berishga tayyor bo'lganidan ko'ra ko'proq qarz olishni xohlashi mumkin. Agar nuqta qizil egri chiziq salbiy boshlanib, o'sish tendentsiyasini ko'rsatmasa r, unda hukumat jamoatchilik har qanday narxda sotmoqchi bo'lmagan narsalarni sotib olishga harakat qilar edi. Keyns bu ehtimolni "ehtimol klassik maktabni biron bir narsa noto'g'ri bo'lganligi to'g'risida ogohlantirishi mumkin" (182-bet) deb ta'kidlaydi.

He also remarks (on the same page) that the classical theory doesn't explain the usual supposition that "an increase in the quantity of money has a tendency to reduce the rate of interest, at any rate in the first instance".

Keynes's diagram of the investment schecule lacks the step shape which can be seen as part of the classical theory. He objects that

the functions used by classical theory... do not furnish material for a theory of the rate of interest; but they could be used to tell us... what the rate of interest will have to be, if the level of employment [which determines income] is maintained at a given figure.[31]

Later (p. 184) Keynes claims that "it involves a circular argument" to construct a theory of interest from the investment schedule since

the 'marginal efficiency of capital' partly depends on the scale of current investment, and we must already know the rate of interest before we can calculate what this scale will be.

Theories of exploitation, productivity and abstinence

The classical theory of interest explains it as the capitalist's share of business profits, but the pre-marginalist authors were unable to reconcile these profits with the qiymatning mehnat nazariyasi (excluding Longfield, who was essentially a marginalist). Their responses often had a moral tone: Ricardo and Marx viewed profits as exploitation, and Makkullox 's productivity theory justified profits by portraying capital equipment as an embodiment of accumulated labor.[22][sahifa kerak ] The theory that interest is a payment for abstinence is attributed to Nassau Senior, and according to Schumpeter[22][sahifa kerak ] was intended neutrally, but it can easily be understood as making a moral claim and was sharply criticised by Marx and Lassalle.

Wicksell's theory

Knut Uiksell published his "Interest and Prices" in 1898, elaborating a comprehensive theory of economic crises based upon a distinction between natural and nominal interest rates.

Wicksell's contribution, in fact, was twofold. First he separated the monetary rate of interest from the hypothetical "natural" rate that would have resulted from equilibrium of capital supply and demand in a barter economy, and he assumed that as a result of the presence of money alone, the effective market rate could fail to correspond to this ideal rate in actuality. Next he supposed that through the mechanism of credit, the rate of interest had an influence on prices; that a rise of the monetary rate above the "natural" level produced a fall, and a decline below that level a rise, in prices. But Wicksell went on to conclude that if the natural rate coincided with the monetary rate, stability of prices would follow.[32]

In the 1930s Wicksell's approach was refined by Bertil Ohlin va Dennis Robertson va nomi bilan tanilgan loanable funds nazariya.

Austrian theories

Eugen Böhm von Bawerk va boshqa a'zolari Avstriya maktabi also put forward notable theories of the interest rate.

The doyen of the Austrian school, Murray N. Rothbard, sees the emphasis on the loan market which makes up the general analysis on interest as a mistaken view to take. As he explains in his primary economic work, Inson, iqtisodiyot va davlat, the market rate of interest is but a namoyon bo'lishi of the natural phenomenon of time preference, which is to prefer present goods to future goods.[33] To Rothbard,

Too many writers consider the rate of interest as only the price of loans on the loan market. In reality...the rate of interest pervades all time markets, and the productive loan market is a strictly subsidiary time market of only derivative importance.[33]:371

Interest is explainable by the rate of time preference among the people. To point to the loan market is insufficient at best. Rather, the rate of interest is what would be observed between the "stages of production", indeed a time market itself, where capital goods which are used to make consumers' goods are ordered out further in time away from the final consumers' goods stage of the economy where consumption takes place. Bu bu spread (between these various stages which will tend toward uniformity), with consumers' goods representing present goods and producers' goods representing future goods, that the real rate of interest is observed. Rothbard has said that

Interest rate is equal to the rate of price spread in the various stages.[33]:371

Rothbard has furthermore criticized the Keynesian conception of interest, saying

One grave and fundamental Keynesian error is to persist in regarding the interest rate as a contract rate on loans, instead of the price spreads between stages of production.[33]:789

Pareto's indifference

Pareto buni ushlab turdi

The interest rate, being one of the many elements of the general system of equilibrium, was, of course, simultaneously determined with all of them so that there was no point at all in looking for any particular element that 'caused' interest.[8-eslatma]

Keynes's theory of the interest rate

Interest is one of the main components of the economic theories developed in Keyns 1936 yil General theory of employment, interest, and money. In his initial account of likvidlikni afzal ko'rish (the demand for money) in Chapter 13, this demand is solely a function of the interest rate; and since the supply is given and equilibrium is assumed, the interest rate is determined by the money supply.

In his later account (Chapter 15), interest cannot be separated from other economic variables and needs to be analysed together with them. Qarang Umumiy nazariya tafsilotlar uchun.

In religious contexts

Yahudiylik

Jews are forbidden from usury in dealing with fellow Jews, and this lending is to be considered tzedakah, or charity. However, there are permissions to charge interest on loans to yahudiy bo'lmaganlar.[35] This is outlined in the Yahudiy oyatlar ning Tavrot, qaysi Nasroniylar hold as part of the Eski Ahd va boshqa kitoblar Tanax. Dan Yahudiy nashrlari jamiyati 's 1917 Tanakh,[36] with Christian verse numbers, where different, in parentheses:

If thou lend money to any of My people, even to the poor with thee, thou shalt not be to him as a creditor; neither shall ye lay upon him interest.

— Exodus 22:24 (25)

Take thou no interest of him or increase; but fear thy God; that thy brother may live with thee.

— Leviticus 25:36

Thou shalt not give him thy money upon interest, nor give him thy victuals for increase.

— Leviticus 25:37

Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest.

— Deuteronomy 23:20 (19)

Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the LORD thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it.

— Deuteronomy 23:21 (20)

... that hath withdrawn his hand from the poor, that hath not received interest nor increase, hath executed Mine ordinances, hath walked in My statutes; he shall not die for the iniquity of his father, he shall surely live.

— Ezekiel 18:17

He that putteth not out his money on interest, nor taketh a bribe against the innocent. He that doeth these things shall never be moved.

— Psalm 15:5

Several historical rulings in Yahudiy qonuni have mitigated the allowances for usury toward non-Jews. For instance, the 15th-century commentator Rabbi Isaac Abrabanel specified that the rubric for allowing interest does not apply to Christians or Muslims, because their faith systems have a common ethical basis originating from Judaism. The medieval commentator Rabbi David Kimchi extended this principle to non-Jews who show consideration for Jews, saying they should be treated with the same consideration when they borrow.[37]

Islom

The following quotations are English translations from the Qur'on:

Those who charge usury are in the same position as those controlled by the devil's influence. This is because they claim that usury is the same as commerce. However, God permits commerce, and prohibits usury. Thus, whoever heeds this commandment from his Lord, and refrains from usury, he may keep his past earnings, and his judgment rests with God. As for those who persist in usury, they incur Hell, wherein they abide forever.

— Al-Baqarah 2:275

God condemns usury, and blesses charities. God dislikes every sinning disbeliever. Those who believe and do good works and establish worship and pay the poor-due, their reward is with their Lord and there shall no fear come upon them neither shall they grieve. O you who believe, you shall observe God and refrain from all kinds of usury, if you are believers. If you do not, then expect a war from God and His messenger. But if you repent, you may keep your capitals, without inflicting injustice, or incurring injustice. If the debtor is unable to pay, wait for a better time. If you give up the loan as a charity, it would be better for you, if you only knew.

— Al-Baqarah 2:276–280

O you who believe, you shall not take usury, compounded over and over. Observe God, that you may succeed.

— Al-'Imran 3:130

And for practicing usury, which was forbidden, and for consuming the people's money illicitly. We have prepared for the disbelievers among them painful retribution.

— Al-Nisa 4:161

The usury that is practiced to increase some people's wealth, does not gain anything at God. But if people give to charity, seeking God's pleasure, these are the ones who receive their reward many fold.

— Ar-Rum 30:39

The attitude of Muhammad to usury is articulated in his Last Sermon

O People, just as you regard this month, this day, this city as Sacred, so regard the life and property of every Muslim as a sacred trust. Return the goods entrusted to you to their rightful owners. Hurt no one so that no one may hurt you. Remember that you will indeed meet your LORD, and that HE will indeed reckon your deeds. ALLAH has forbidden you to take usury, therefore all usurious obligation shall henceforth be waived. Your capital, however, is yours to keep. You will neither inflict nor suffer any inequity. Allah has Judged that there shall be no usury and that all the usury due to Abbas ibn 'Abd'al Muttalib (Prophet's uncle) shall henceforth be waived ...[38][ishonchli manba? ]

Nasroniylik

The Eski Ahd "condemns the practice of charging interest because a loan should be an act of compassion and taking care of one's neighbor"; it teaches that "making a profit off a loan is exploiting that person and dishonoring God's covenant (Exodus 22:25–27)".[40]

Birinchisi maktab Christian theologians, Keyntberining avliyo Anselmi, led the shift in thought that labeled charging interest the same as theft. Previously usury had been seen as a lack of xayriya.

St. Tomas Akvinskiy, the leading scholastic theologian of the Rim-katolik cherkovi, argued charging of interest is wrong because it amounts to "double charging", charging for both the thing and the use of the thing. Aquinas said this would be morally wrong in the same way as if one sold a bottle of wine, charged for the bottle of wine, and then charged for the person using the wine to actually drink it.[41] Similarly, one cannot charge for a piece of cake and for the eating of the piece of cake. Yet this, said Aquinas, is what usury does. Money is a medium of exchange, and is used up when it is spent. To charge for the money and for its use (by spending) is therefore to charge for the money twice. It is also to sell time since the usurer charges, in effect, for the time that the money is in the hands of the borrower. Time, however, is not a commodity that anyone can charge. In condemning usury Aquinas was much influenced by the recently rediscovered philosophical writings of Aristotel and his desire to assimilate Yunon falsafasi bilan Xristian ilohiyoti. Aquinas argued that in the case of usury, as in other aspects of Christian revelation, Christian doctrine is reinforced by Aristotelian tabiiy qonun rationalism. Aristotle's argument is that interest is unnatural, since money, as a sterile element, cannot naturally reproduce itself. Thus, usury conflicts with natural law just as it offends Christian revelation: see Foma Akvinskiyning fikri. As such, Aquinas taught "that interest is inherently unjust and one who charges interest sins."[40]

Outlawing usury did not prevent investment, but stipulated that in order for the investor to share in the profit he must share the risk. In short he must be a joint-venturer. Simply to invest the money and expect it to be returned regardless of the success of the venture was to make money simply by having money and not by taking any risk or by doing any work or by any effort or sacrifice at all, which is usury. St Thomas quotes Aristotle as saying that "to live by usury is exceedingly unnatural". Islam likewise condemns usury but allowed commerce (Al-Baqarah 2:275) – an alternative that suggests investment and sharing of profit and loss instead of sharing only profit through interests. Judaism condemns usury towards Jews, but allows it towards non-Jews (Deut. 23:19–20). St Thomas allows, however, charges for actual services provided. Thus a banker or credit-lender could charge for such actual work or effort as he did carry out, for example, any fair administrative charges. The Catholic Church, in a decree of the Lateranning beshinchi kengashi, expressly allowed such charges in respect of credit-unions run for the benefit of the poor known as "montes pietatis ".[42]

XIII asrda Cardinal Hostiensis enumerated thirteen situations in which charging interest was not immoral.[43] Ulardan eng muhimi edi lucrum cessans (profits given up) which allowed for the lender to charge interest "to compensate him for profit foregone in investing the money himself" (Rothbard 1995, p. 46). This idea is very similar to opportunity cost. Many scholastic thinkers who argued for a ban on interest charges also argued for the legitimacy of lucrum cessans profits (for example, Per Jan Olivi va St. Bernardino of Siena ). However, Hostiensis' exceptions, including for lucrum cessans, were never accepted as official by the Roman Catholic Church.

The Westminster e'tiqodi, a confession of faith upheld by the Islohot qilingan cherkovlar, teaches that usury--charging interest at any rate--is a gunoh tomonidan taqiqlangan eighth commandment.[44]

The Roman Catholic Church has always condemned usury, but in modern times, with the rise of capitalism and the disestablishment of the Catholic Church in majority Catholic countries, this prohibition on usury has not been enforced.

Papa Benedikt XIV qomusiy Vix Pervenit gives the reasons why usury is sinful:[45]

The nature of the sin called usury has its proper place and origin in a loan contract ... [which] demands, by its very nature, that one return to another only as much as he has received. The sin rests on the fact that sometimes the creditor desires more than he has given ..., but any gain which exceeds the amount he gave is illicit and usurious.One cannot condone the sin of usury by arguing that the gain is not great or excessive, but rather moderate or small; neither can it be condoned by arguing that the borrower is rich; nor even by arguing that the money borrowed is not left idle, but is spent usefully ...[46]

The Congregation of the Missionary Sons of the Immaculate Heart of Mary, a Catholic Christian diniy tartib, thus teaches that:[40]

It might initially seem like little is at stake when it comes to interest, but this is an issue of human dignity. A person is made in God's own image and therefore may never be treated as a thing. Interest can diminish the human person to a thing to be manipulated for money. In an article for The Catholic Worker, Dorothy Day articulated this well: "Can I talk about the people living off usury . . . not knowing the way that their infertile money has bred more money by wise investment in God knows what devilish nerve gas, drugs, napalm, missiles, or vanities, when housing and employment . . . for the poor were needed, and money could have been invested there?" Her thoughts were a precursor to what Pope Francis now calls an "economy that kills." To sin is to say "no" to God and God's presence by harming others, ourselves, or all of creation. Charging interest is indeed sinful when doing so takes advantage of a person in need as well as when it means investing in corporations involved in the harming of God's creatures.[40]

Shuningdek qarang

- Aktuar yozuvlari

- Kredit karta bo'yicha foizlar

- Kredit reyting agentligi

- DIRTI 5

- Chegirma

- Fisher tenglamasi

- Ijaraga sotib olish

- Foizlar bo'yicha xarajatlar

- Lizing

- Veksel

- Xavfsiz foiz stavkasi

Izohlar

- ^ "Barbon's Discourse, on this point at all events, did not meet with success. The tract seems indeed to have been forgotten very soon. Thus, Barbon's fundamental idea remained in abeyance until 1750, when it was again expounded—for all we know, independently rediscovered—by Massie,[20] whose analysis not only went further than Barbon's but also gathered force from its criticism of the views of Petty and Locke."[21]

- ^ Schumpeter;[23] the references are to paragraph numbers in Turgot's "Réflexions sur la formation et la distribution des richesses" written in 1766, first published in 1769-70 in a journal, and then separately in 1776.

- ^ Isolated remarks in the chapters "Effects of accumulation on profits and interest" and "On currency and banks" in "Principles of political economy and taxation"

- ^ "The general theory of employment, interest and money", especially the appendix to Chapter 14. Page numbers refer to the widely available edition published by Macmillan for the Royal Economic Society as part of Keynes's collected writings, which appear to correspond to those of the first edition.

- ^ See also his chapters "Of the law of the increase of capital" and "Of profits"

- ^ Chapter 11 of The General Theory is titled "The Marginal Efficiency of Capital." Marshal atamani ishlatgan marginal utility of capital and Fisher rate of return over cost. Fisher also referred to it as representing the "investment opportunity side of interest theory".

- ^ Keynes called this function the 'schedule of the marginal efficiency of capital' and also the 'investment demand schedule'.

- ^ Unsourced observation in Schumpeter[34]

Kabi tuzilmalar shu erda., lok. keltirish. va idem bor tushkunlikka tushgan Vikipediyaning uslubiy qo'llanmasi izohlar uchun, chunki ular osongina sindirilgan. Iltimos ushbu maqolani yaxshilang ularni almashtirish bilan nomlangan ma'lumotnomalar (tezkor qo'llanma) yoki qisqartirilgan sarlavha. (2019 yil may) (Ushbu shablon xabarini qanday va qachon olib tashlashni bilib oling) |

- ^ "Definition of interest in English". Ingliz tili Oksfordning yashash lug'atlari. Oksford universiteti matbuoti. Olingan 27 dekabr 2017.

Money paid regularly at a particular rate for the use of money lent, or for delaying the repayment of a debt.

- ^ "Definition of dividend". Merriam Vebster. Merriam Vebster. Olingan 27 dekabr 2017.

a share in a pro rata distribution (as of profits) to stockholders.

- ^ "Foyda". Iqtisodiyot Onlayn. Olingan 27 dekabr 2017.

- ^ O'Connor, J J. "The number e". MacTutor Matematika tarixi. Olingan 26 avgust 2012.

- ^ Jonson, Pol: Yahudiylar tarixi (New York: HarperCollins Publishers, 1987) ISBN 0-06-091533-1, 172-73-betlar.

- ^ "How the world's first accountants counted on cuneiform". BBC Jahon xizmati. 12 iyun 2017 yil.

- ^ "A Simple Math Formula Is Basically Responsible For All Of Modern Civilization". Business Insider. 2013 yil 5-iyun.

- ^ Gnuse, Robert (2011-08-05). You Shall Not Steal: Community and Property in the Biblical Tradition. Wipf va Stock Publishers. ISBN 9781610975803.

- ^ "Institute of Islamic Banking and Insurance - Prohibition of Interest". www.islamic-banking.com. Olingan 2015-10-12.

- ^ a b Conrad Henry Moehlman (1934). The Christianization of Interest. Church History, 3, p 6. doi:10.2307/3161033.

- ^ Noonan, John T., Jr. 1993. "Development of Moral Doctrine." 54 Theological Stud. 662.

- ^ No. 2547: Charging Interest

- ^ O'Konnor, JJ; Robertson, E F. "The number e". MacTutor Matematika tarixi. Arxivlandi asl nusxasi 2008-08-28 kunlari.

- ^ Bohm-Bawerk, E. (1884) Capital and Interest: A Critical History of Economic Theory.

- ^ a b Rule of 78 - Watch out for this auto loan trick

- ^ 15 AQSh § 1615

- ^ "What's the Relationship Between Inflation and Interest Rates?". PBS NewsHour. 2009-06-23. Olingan 2020-08-31.

- ^ Schumpeter 1954, p. 61.

- ^ Barbon, "A discourse of trade", 1690; Schumpeter, op. keltirish.; William Letwin, "Origins of Scientific Economics: English Economic Thought, 1660–1776".

- ^ Massie, Joseph (1750). Essay on the Governing Causes of the Natural Rate of Interest.

- ^ Schumpeter 1954, p. 314.

- ^ a b v Shumpeter.

- ^ Shumpeter, p. 316.

- ^ "Lectures on political economy", IX.

- ^ "The rate of interest", 1907.

- ^ "Of the rate of interest", §1.

- ^ §2.

- ^ Ricardo, chapter "On currency and banks"

- ^ a b Mill §3; Longfield.

- ^ §3.

- ^ p181.

- ^ Etien Mantu, "Mr Keynes' Umumiy nazariya", Revue d'Économie Politique, 1937, tr. yilda Genri Hazlitt, "The critics of Keynesian economics", 1960.

- ^ a b v d Rothbard, Murray N. (2001). Man, economy, and state : a treatise on economic principles (Rev.). Auburn, Alabama: Mises instituti. ISBN 0945466323. OCLC 47279566.

- ^ Shumpeter, p. 892.

- ^ Robinzon, Jorj. "Interest-Free Loans in Judaism". Olingan 12 mart 2015.

- ^ "A Hebrew – English Bible According to the Masoretic Text and the JPS 1917 Edition". Olingan 4 yanvar 2013.

- ^ "Encyclopedia Judaica: Moneylending". Yahudiylarning virtual kutubxonasi. 2008. Olingan 16 oktyabr, 2017.

- ^ "IslamiCity.com - Mosque - The Prophet Muhammad's (PBUH) Last Sermon". www.islamicity.com.

- ^ The references cited in the Passionary for this woodcut: 1 John 2:14–16, Matto 10: 8 va The Apology of the Augsburg Confession, Article 8, Of the Church

- ^ a b v d Considine, Kevin P. (2016). "Is it sinful to charge interest on a loan?". U.S. Catholic. Olingan 4 iyun 2020.

- ^ Tomas Akvinskiy. Summa Theologica, "Of Cheating, Which Is Committed in Buying and Selling". Translated by The Fathers of the English Dominican Province. 1-10 betlar [1] 2012 yil 19-iyun kuni olingan

- ^ Session Ten: On the reform of credit organisations (Montes pietatis). Beshinchi lateran kengashi. Rim, Italiya: Katolik cherkovi. 4 May 1515. Olingan 2008-04-05.

- ^ Roover, Raymond (Autumn 1967). "The Scholastics, Usury, and Foreign Exchang". Biznes tarixi sharhi. The Business History Review, Vol. 41, No. 3. 41 (3): 257–271. doi:10.2307/3112192. JSTOR 3112192.

- ^ Cox, Robert (1853). Sabbath Laws and Sabbath Duties: Considered in Relation to Their Natural and Scriptural Grounds, and to the Principles of Religious Liberty. Maclachlan and Stewart. p. 180.

- ^ Shuningdek qarang: Church and the Usurers: Unprofitable Lending for the Modern Economy Arxivlandi 2015-10-17 da Orqaga qaytish mashinasi tomonidan Dr. Brian McCall yoki Interest and Usury tomonidan Fr. Bernard W. Dempsey, S.J. (1903–1960).)

- ^ "Vix Pervenit - Papal Encyclicals". 1 November 1745.

Adabiyotlar

- Duffie, Darrell and Kenneth J. Singleton (2003). Credit Risk: Pricing, Measurement, and Management. Prinston universiteti matbuoti. ISBN 978-0-691-09046-7.

- Kellison, Stephen G. (1970). Qiziqishlar nazariyasi. Richard D. Irwin, Inc. Library of Congress Catalog Card No. 79-98251.

- Lando, David (2004). Credit Risk Modeling: Theory and Applications. Prinston universiteti matbuoti. ISBN 978-0-691-08929-4.

- van Deventer, Donald R. and Kenji Imai (2003). Credit Risk Models and the Basel Accords. John Wiley & Sons. ISBN 978-0-470-82091-9.

- Shumpeter, Jozef (1954). Iqtisodiy tahlil tarixi. Allen va Unvin.

Tashqi havolalar

- White Paper: More than Math, The Lost Art of Interest calculation

- Mortgages made clear Moliyaviy xizmatlar vakolatxonasi (Buyuk Britaniya)

- OECD interest rate statistics

- You can see a list of current interest rates at these sites:

- Deposit Rates in European Countries

![p = r chap [ frac {(1 + r) ^ n B_0 - B_n} {(1 + r) ^ n - 1} o'ng]](https://wikimedia.org/api/rest_v1/media/math/render/svg/5f3ee5f10636fe810c67647a429fd5a914b82c88)

![lambda_k = frac {p_k} {p} = frac {r_k} {r} = frac {(1 + r) ^ k - 1} {r} = k chap [1 + frac {(k - 1) r} {2} + cdots o'ng]](https://wikimedia.org/api/rest_v1/media/math/render/svg/9b1914300905ee6d4cadcc5e32dbd20d7c706d58)